Statistical inference¶

The procedure of drawing conclusions about model parameters from randomly distributed data is known as statistical inference. This section explains the mathematical theory behind statistical inference. If you are already familiar with this subject feel free to skip to the next section.

General case¶

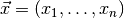

For a statistician a model is simply a probability density function (PDF)

, which describes the (joint) distribution of a set of observables

, which describes the (joint) distribution of a set of observables

in the sample space

in the sample space  and

depends on some parameters

and

depends on some parameters  . The parameter space

. The parameter space

can be any (discrete or continuous) set and

can be any (discrete or continuous) set and  can be any

function of

can be any

function of  and

and  with

with

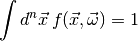

(1)

for all  . Statistical inference can help us answer

the following questions:

. Statistical inference can help us answer

the following questions:

- Which choice of the parameters is most compatible with some observed

data

?

? - Based on the observed data

, which parts of the parameter

space

, which parts of the parameter

space  can be ruled out (at which confidence level)?

can be ruled out (at which confidence level)?

Let us begin with the first question. What we need is a function

which assigns to each observable vector

which assigns to each observable vector

an estimate of the model parameters. Such a function is called an

estimator. There are different ways to define an estimator, but the most

popular choice (and the one that myFitter supports) is the

maximum likelihood estimator defined by

an estimate of the model parameters. Such a function is called an

estimator. There are different ways to define an estimator, but the most

popular choice (and the one that myFitter supports) is the

maximum likelihood estimator defined by

In other words, for a given observation  the maximum likelihood

estimate of the parameters are those parameters which maximise

the maximum likelihood

estimate of the parameters are those parameters which maximise  . When we keep the observables fixed and regard

. When we keep the observables fixed and regard  as a function

of the parameters we call it the likelihood function. Finding the maximum of

the likelihood function is commonly referred to as fitting the model

as a function

of the parameters we call it the likelihood function. Finding the maximum of

the likelihood function is commonly referred to as fitting the model  to the data

to the data  . It usually requires numerical optimisation

techniques.

. It usually requires numerical optimisation

techniques.

The second question is answered (in frequentist statistics) by performing a

hypothesis test. Let’s say we want know if the model is realised with

parameters from some subset  . We call this the

null hypothesis. To test this hypothesis we have to define some function

. We call this the

null hypothesis. To test this hypothesis we have to define some function

, called test statistic, which quantifies the disagreement of

the observation

, called test statistic, which quantifies the disagreement of

the observation  with the null hypothesis. The phrase

“quantifying the disagreement” is meant in the rather vague sense that

with the null hypothesis. The phrase

“quantifying the disagreement” is meant in the rather vague sense that

should be large when

should be large when  looks like it was not

drawn from a distribution with parameters in

looks like it was not

drawn from a distribution with parameters in  . In principle any

function on

. In principle any

function on  can be used as a test statistic, but of course

some are less useful than others. The most popular choice (and the one

myFitter is designed for) is

can be used as a test statistic, but of course

some are less useful than others. The most popular choice (and the one

myFitter is designed for) is

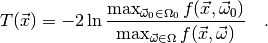

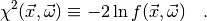

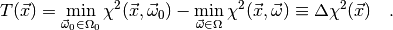

For this choice of  , the test is called a likelihood ratio test.

With a slight abuse of notation, we define

, the test is called a likelihood ratio test.

With a slight abuse of notation, we define

(2)

Then we may write

(3)

Clearly large values of  indicate that the null hypothesis

is unlikely, but at which value should we reject it? To determine that we have to

compute another quantity called the p-value

indicate that the null hypothesis

is unlikely, but at which value should we reject it? To determine that we have to

compute another quantity called the p-value

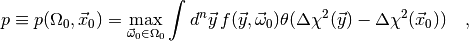

(4)

where  is the Heavyside step function. Note that the integral is

simply the probability that for some random vector

is the Heavyside step function. Note that the integral is

simply the probability that for some random vector  of toy

observables drawn from the distribution

of toy

observables drawn from the distribution  the test

statistic

the test

statistic  is larger than the observed value

is larger than the observed value

. The meaning of the p-value is the following: if

the null hypothesis is true and we reject it for values of

. The meaning of the p-value is the following: if

the null hypothesis is true and we reject it for values of  larger than the observed value

larger than the observed value  the probability

for wrongly rejecting the null hypothesis is at most

the probability

for wrongly rejecting the null hypothesis is at most  . Thus, the smaller the p-value, the more confident we can be in rejecting

the null hypothesis. The complementary probability

. Thus, the smaller the p-value, the more confident we can be in rejecting

the null hypothesis. The complementary probability  is therefore called the confidence level at which we may reject the null

hypothesis

is therefore called the confidence level at which we may reject the null

hypothesis  , based on the observation

, based on the observation  .

.

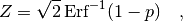

Instead of specifying the p-value directly people often give the Z-value (or number of ‘standard deviations‘ or ‘sigmas‘) which is related to the p-value by

where ‘ ‘ denotes the error function. The relation is chosen in such

a way that the integral of a normal distribution from

‘ denotes the error function. The relation is chosen in such

a way that the integral of a normal distribution from  to

to  is the confidence level

is the confidence level  . So, if someone tells you that they have

discovered something at

. So, if someone tells you that they have

discovered something at  they have (usually) done a likelihood

ratio test and rejected the “no signal” hypothesis at a confidence level

corresponding to

they have (usually) done a likelihood

ratio test and rejected the “no signal” hypothesis at a confidence level

corresponding to  .

.

Linear regression models and Wilks’ theorem¶

Evaluating the right-hand side of (4) exactly for a realistic model can be extremely challenging. However, for a specific class of models called linear regression models we can evaluate (4) analytically. The good news is that most models can be approximated by linear regression models and that this approximation is often sufficient for the purpose of estimating the p-value. A concrete formulation of this statement is given by a theorem by Wilks, which we shall discuss shortly. The myFitter package was originally written to handle problems where Wilks’ theorem is not applicable, but of course the framework can also be used in cases where Wilks’ theorem applies.

In a linear regression model the parameter space  is a

is a

-dimensional real vector space and the PDF

-dimensional real vector space and the PDF  is a

(multi-dimensional) normal distribution with a fixed

(i.e. parameter-independent) covariance matrix

is a

(multi-dimensional) normal distribution with a fixed

(i.e. parameter-independent) covariance matrix  centered on an

observable-vector

centered on an

observable-vector  which is an affine-linear function

of the parameters

which is an affine-linear function

of the parameters  :

:

(5)![f(\vec x,\vec\omega) &= \mathcal{N}(\vec\mu(\vec\omega), \Sigma)(\vec x)

\propto \exp[-\tfrac12(\vec x-\vec\mu(\vec\omega))^\trans \Sigma^{-1}

(\vec x-\vec\mu(\vec\omega))]

\eqsep,\\

\vec\mu(\vec\omega) &= A\vec\omega + \vec b

\eqsep,](_images/math/c615d9870c3fc73cf6983b83826bdf449448f79d.png)

where  is a symmetric, positive definite matrix,

is a symmetric, positive definite matrix,  is a

non-singular (

is a

non-singular ( )-matrix and

)-matrix and  is a

is a

-dimensional real vector. Now assume that the parameter space

-dimensional real vector. Now assume that the parameter space

under the null hypothesis is a

under the null hypothesis is a  -dimensional affine

sub-space of

-dimensional affine

sub-space of  (i.e. a linear sub-space with a constant shift).

In this case the formula (4) for the p-value becomes

(i.e. a linear sub-space with a constant shift).

In this case the formula (4) for the p-value becomes

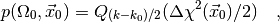

(6)

where  is the normalised upper incomplete Gamma function which can be

found in any decent special functions library. Note that, for a linear regession

model, the p-value only depends on the dimension of the affine sub-space

is the normalised upper incomplete Gamma function which can be

found in any decent special functions library. Note that, for a linear regession

model, the p-value only depends on the dimension of the affine sub-space

but not on its position within the larger space

but not on its position within the larger space  .

.

The models we encounter in global fits are usually not linear regession models.

They typically belong to a class of models known as non-linear regression

models. The PDF of a non-linear regression model still has the form

(5) with a fixed covariance matrix  , but the

means

, but the

means  may depend on the parameters

may depend on the parameters  in an

arbitrary way. Furthermore, the parameter spaces

in an

arbitrary way. Furthermore, the parameter spaces  and

and

don’t have to be vector spaces but can be arbitrary smooth

manifolds. The means

don’t have to be vector spaces but can be arbitrary smooth

manifolds. The means  of a non-linear regression model are

usually the theory predictions for the observables and have a known functional

dependence on the parameters

of a non-linear regression model are

usually the theory predictions for the observables and have a known functional

dependence on the parameters  of the theory. The information

about experimental uncertainties (and correlations) is encoded in the covariance

matrix

of the theory. The information

about experimental uncertainties (and correlations) is encoded in the covariance

matrix  .

.

Since any smooth non-linear function can be locally approximated by a linear

function it seems plausible that (6) can still hold approximately even

for non-linear regression models. This is essentially the content of Wilks’

theorem. It states that, for a general model (not only non-linear regression

models) which satisfies certain regularity conditions, (6) holds

asymptotically in the limit of an infinite number of independent

observations. The parameter spaces  and

and  in the

general case can be smooth manifolds with dimensions

in the

general case can be smooth manifolds with dimensions  and

and

, respectively. Note, however, that for Wilks’ theorem to hold

, respectively. Note, however, that for Wilks’ theorem to hold

must still be a subset of

must still be a subset of  .

.

Plug-in p-values and the myFitter method¶

In practice we cannot make an arbitrarily large number of independent

observations. Thus (6) is only an approximation whose quality depends on

the amount of collected data and the model under consideration. To test the

quality of the approximation (6) for a specific model one must evaluate

or at least approximate (4) by other means, e.g. numerically. Such

computations are called toy simulations, and their computational cost can be

immense. Note that the evaluation of  (and thus of the

integrand in (4)) requires a numerical optimisation. And then the

integral in (4) still needs to be maximised over

(and thus of the

integrand in (4)) requires a numerical optimisation. And then the

integral in (4) still needs to be maximised over  .

.

In most cases the integral is reasonably close to its maxiumum value when

is set to its maximum likelihood estimate for the

observed data

is set to its maximum likelihood estimate for the

observed data  and the parameter space

and the parameter space  :

:

Thus, the plug-in p-value

is often a good approximation to the real p-value.

The standard numerical approach to computing the remaining integral is to

generate a large number of toy observations  distributed according to

distributed according to  and then determine the fraction of toy observations where

and then determine the fraction of toy observations where

. If the p-value is small

this method can become very inefficient. The efficiency can be significantly

improved by importance sampling methods, i.e. by drawing toy observations

from some other (suitably constructed) sampling density which avoids the region

with

. If the p-value is small

this method can become very inefficient. The efficiency can be significantly

improved by importance sampling methods, i.e. by drawing toy observations

from some other (suitably constructed) sampling density which avoids the region

with  . This method lies at

the heart of the myFitter package.

. This method lies at

the heart of the myFitter package.

Gaussian and systematic errors¶

As mentioned above the most common type of model we deal with in global fits are

non-linear regression models where the means

represent theoretical predictions for the

observables and the information about experimental uncertainties is encoded in

the covariance matrix

represent theoretical predictions for the

observables and the information about experimental uncertainties is encoded in

the covariance matrix  . If the value of an observable is given as

. If the value of an observable is given as

in a scientific text this usually implies that the observable

has a Gaussian distribution with a standard deviation of 0.5. Measurements

from different experiments are usually uncorrelated. Thus the covariance matrix

for

in a scientific text this usually implies that the observable

has a Gaussian distribution with a standard deviation of 0.5. Measurements

from different experiments are usually uncorrelated. Thus the covariance matrix

for  independent observables is

independent observables is

where the  are the errors of the individual measurements. If

several quantities are measured in the same experiment they can be correlated.

Information about the correlations is usually presented in the form of a

correlation matrix

are the errors of the individual measurements. If

several quantities are measured in the same experiment they can be correlated.

Information about the correlations is usually presented in the form of a

correlation matrix  . The correlation matrix is always symmetric

and its diagonal entries are 1. (Thus it is common to only show the lower or

upper triangle of

. The correlation matrix is always symmetric

and its diagonal entries are 1. (Thus it is common to only show the lower or

upper triangle of  in a publication.) The elements

in a publication.) The elements  of

of  are called correlation coefficients. For

are called correlation coefficients. For  observables

with errors

observables

with errors  and correlation coefficients

and correlation coefficients  the covariance matrix

the covariance matrix  is given by

is given by

In some cases the error of an observable is broken up into a statistical and a

systematic component. Typical notations are  or simply

or simply  with an indication which

component is the systematic one given in the text. Sometimes the systematic

error is asymmetric and denoted as

with an indication which

component is the systematic one given in the text. Sometimes the systematic

error is asymmetric and denoted as  .

.

What are we supposed to do with this extra information? This depends largely on

the context, i.e. on the nature of the systematic uncertainties being

quoted. For example, the theoretical prediction of an observable  (or

its extraction from raw experimental data) might require knowledge of some other

quantity

(or

its extraction from raw experimental data) might require knowledge of some other

quantity  which has been measured elsewhere with some Gaussian

uncertainty. In this case one also speaks of a parametric uncertainty. If you

know the dependence of

which has been measured elsewhere with some Gaussian

uncertainty. In this case one also speaks of a parametric uncertainty. If you

know the dependence of  on

on  it is best to treat

it is best to treat

as a parameter of your model, add an observable which represents

the measurement of

as a parameter of your model, add an observable which represents

the measurement of  (i.e. with a Gaussian distribution centered

on

(i.e. with a Gaussian distribution centered

on  and an appropriate standard deviation), and use only the

statistical error to model the distribution of

and an appropriate standard deviation), and use only the

statistical error to model the distribution of  . In particular, this is

the only (correct) way in which you can combine

. In particular, this is

the only (correct) way in which you can combine  with other observables

that depend on the same parameter

with other observables

that depend on the same parameter  . In this case the parameter

. In this case the parameter

is called a nuisance parameter, since we are not interested in

its value but need it to extract values for the parameters we are interested in.

is called a nuisance parameter, since we are not interested in

its value but need it to extract values for the parameters we are interested in.

If you don’t know the dependence of  on

on  but you are

sure that the systematic uncertainty for

but you are

sure that the systematic uncertainty for  given in a paper is (mainly)

parametric due to

given in a paper is (mainly)

parametric due to  and that

and that  does not affect any

other observables in your fit you can combine the statistical and systematic

error in quadrature. This means you assume a Gaussian distribution for

does not affect any

other observables in your fit you can combine the statistical and systematic

error in quadrature. This means you assume a Gaussian distribution for  with standard deviation

with standard deviation  , where

, where  is the

statistical and

is the

statistical and  the systematic error (which should be

symmetric in this case). This procedure is also correct if the systematic error

is the combined parametric uncertainty due to several parameters, as long as

none of these parameters affect any other observables in your fit.

the systematic error (which should be

symmetric in this case). This procedure is also correct if the systematic error

is the combined parametric uncertainty due to several parameters, as long as

none of these parameters affect any other observables in your fit.

So far in our discussion we have assumed that the nuisance parameter(s)  can be measured and have a Gaussian

distribution. This is not always the case. If, for example, the theoretical

prediction for an observable is an approximation there will be a constant offset

between the theory prediction and the measured value. This offset does not

average out when the experiment is repeated many times, and it cannot be

measured separately either. At best we can find some sort of upper bound on the

size of this offset. The extraction of an observable from the raw data may also

depend on parameters which can only be bounded but not measured. In this case

the offset between the theory prediction and the mean of the measured quantity

should be treated as an additional model parameter whose values are restricted

to a finite range. Assume that the systematic error of

can be measured and have a Gaussian

distribution. This is not always the case. If, for example, the theoretical

prediction for an observable is an approximation there will be a constant offset

between the theory prediction and the measured value. This offset does not

average out when the experiment is repeated many times, and it cannot be

measured separately either. At best we can find some sort of upper bound on the

size of this offset. The extraction of an observable from the raw data may also

depend on parameters which can only be bounded but not measured. In this case

the offset between the theory prediction and the mean of the measured quantity

should be treated as an additional model parameter whose values are restricted

to a finite range. Assume that the systematic error of  is given as

is given as

with

with  . Let

. Let

be the theory prediction for

be the theory prediction for  . The

mean

. The

mean  of the observable

of the observable  then depends on an additional

nuisance parameter

then depends on an additional

nuisance parameter  which takes values in the interval

which takes values in the interval

![[-\delta_-,+\delta_+]](_images/math/8f9cc14feb9c81a1e6fc499628c564365ba1b521.png) :

:

![\mu(\vec\omega,\delta) = \mu_\text{th}(\vec\omega) - \delta

\eqsep\text{with}\eqsep\delta\in[-\delta_-,+\delta_+]

\eqsep.](_images/math/36d7f3335de29fe8553095497e41a124c8dd11cb.png)

Note that the formula above holds for systematic uncertainties associated with

the measurement of  . If the theory prediction for an observable

is quoted with a systematic error

. If the theory prediction for an observable

is quoted with a systematic error  the correct

range for

the correct

range for  is

is ![[-\delta_+,+\delta_-]](_images/math/00514eea4c3385f9712de2d809c7115e8a32ae31.png) .

.